Three bills introduced in the 2019 Hawaii legislature session directly address state land leases. The first of these we will discuss here on DarkerView is SB905 which attempts to assess reasonable compensation for such a lease.

When considering the issues of land leases in Hawaii there are a few important things to consider. The vast majority of land in the state is owned by either the state itself, or by a handful of large landowners. These entities do not typically sell land, rather much of the land is in long term lease to the current users.

A significant number of commercial developments, some military bases, and large resorts sit upon leased land. Malls, apartment complexes, and a surprising number of private homes are on leased land. This leads to a wide range of potential issues when the leases run out or are open to renegotiation. Sometimes it gets ugly, with families evicted from homes that have been in the family for generations.

As one would expect, the leasing of state land can quickly become a hot political issue. A great deal of land use law, and an even larger body of case law revolves around these leases.

SB905

The first of the bills proposed in the current legislative session concerning leases is SB905. This bill requires the lessor of a master lease for public land to receive reasonable compensation. This seems reasonable, and for much of state land may actually make sense.

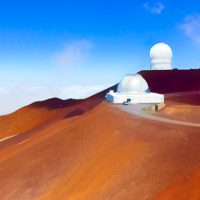

Given the context of the bill package this bill was submitted alongside it appears that SB905 is aimed at the Mauna Kea observatories where lease payments are part of the controversy. When applied to Mauna Kea lands there are issues that make this simple bill problematic.

The use of appraisal to set the value is the major change here. The current methods in state land use law for determining lease payments are public auction in §171-35(4), a percentage of gross receipts in §171-36(6), or as set by the land board in §171-35(4) which is the usual solution.

§171- Public lands master lease; reasonable compensation. Notwithstanding any other law to the contrary, any master lease for public land entered into pursuant to this chapter shall require the lessor to receive reasonable compensation, which shall be determined by appraisal.

Changes proposed by SB905 from the 2019 Hawaii Legislature session

The difficulty comes when assigning a value to an observatory lease. For a commercial property this is easy, use the market value for similar properties. Problem… There are no comparable market values to use when determining a lease for an observatory on the summit of Mauna Kea.

The problem of charging for a lease gets even more problematic…

Three of the telescopes atop Mauna Kea are operated in whole or in part by the University of Hawaii. Any lease monies would come from state funds, to be paid back to state funds? You can see the absurdity here . Simply taking money from one pocket and placing it in another, an accounting exercise that serves little real purpose.

Three more telescopes are owned wholly by the US government, the NASA IRTF, VLBA, and Gemini. Charge the feds rent? The State of Hawaii already receives far more federal monies than it pays in federal taxes, over twice as much. Some here in the state may consider this a good idea, while others may wish to object, with good reason.

All of the telescopes upon Mauna Kea are primarily supported by tax money from somewhere. While money may make its way from some general revenue fund, through a university, to the observatory, it came originally from someone’s taxes. This makes the question of a lease payment simply a matter of redistributing taxes.

A commercial lease could use a percentage of profits or gross reciepts as the basis for determining a lease payment. This is common with some state land uses such as mining, forestry, or grazing leases. What if there is no profit?

Opponents of astronomy on Mauna Kea cry loudly about the lack of substantive lease payments from the observatories. Many claims are made about huge profits earned by the observatories, why is the state not getting a share?

Therein lies the lie, there are no profits. The observatories spend money, they do not make it. The observatories atop Mauna Kea are either directly government supported or non-profit corporations owned by governments and universities. This defines the problem when attempting to determine a fair lease payment.

Any appraisal used to determine a fair least payment for an observatory would quickly become a political exercise with no basis in practical reality.